Using This Year’s Tax Pitfalls to Improve Next Year’s Close

The accounting department kicks into high gear during the period between the first of the year and the mid-spring tax deadline, also known as the year end close. Accountants have just a few months to close out last year and prepare to file. It can be a stressful time, even at smaller companies, because there are significant repercussions for any tax problems.

When you’re in the midst of this process (like right now), it’s the wrong time to tinker with how it proceeds. However, it’s the perfect time to start recording what goes right and wrong so that you can use that information to improve next year’s first-quarter financial obligations.

Ideally, you spend the eight months between the end of this year’s tax season and the start of next year’s addressing the issues that compromised the 2020 year-end close. Realistically, however, you probably lack the budget to hire a bunch of new accountants and lack the time to totally transform your financial problems. Therefore, closing out the 2021 books is going to feel very familiar.

But what if there were an alternative to investing in time and talent? Investing in technology instead saves you days of tedious work while multiplying the productivity of your team. Optimizing next year’s tax season could be as simple as implementing the right financial management solution. Specifically, Sage Intacct.

Thanks to its smart features and intuitive tools, Sage Intacct upgrades all facets of accounting every month of the year. Around this part of the calendar, however, the strengths of the software really become apparent. Here are some examples of capabilities you would like to be using now and should plan on using next year:

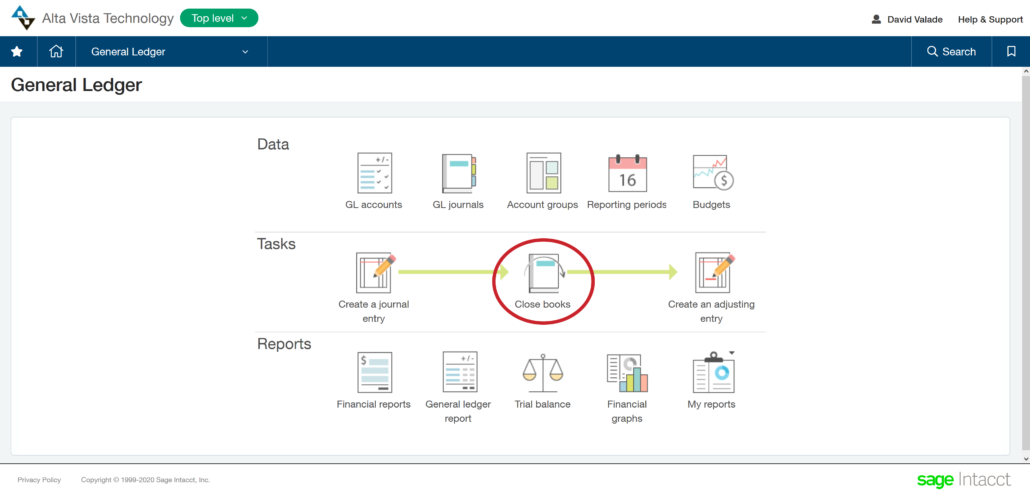

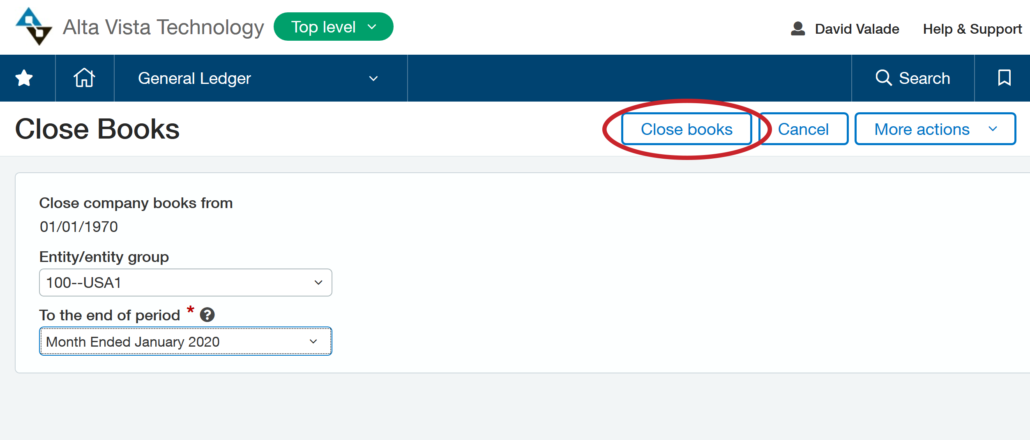

Put the Year-End Close on Autopilot

The year-end close tends to be a slow, meticulous process involving careful data entry and thorough cross-referencing. It’s not surprising that accountants dread this work or that it tends to be plagued by errors and inefficiencies. With Sage Intacct, closing out last year’s books involves just a few clicks even if you haven’t been diligent about the month-end close throughout the year. Automation makes an all-consuming process almost effortless.

Avoid Adjusting the Retained Earnings

Typically, after the year-end close accountants have to manually record earnings/losses into the retained earnings ledger. That step only complicates an already demanding process, which is why Sage Intacct eliminates it. Instead, the technology has a “virtual close” where retained earnings are automatically shown while the accounting team focuses their efforts elsewhere.

Automatically Produce 1099s

Depending on the size of your organization, distributing 1099s can be a big headache. Once again, Sage Intacct optimizes the process to the point where it’s almost hands-off. The system will track 1099 information for you, and after you confirm that the entries/amounts are correct, you can easily format and print the documents.

This piece barely scratches the surface of what Sage Intacct can do before, during, and after tax season. When you’re ready to learn more, don’t hesitate to give us a call at 855.913.3228 or fill out our web form. At Alta Vista Technology we take pride in being part of your solution.