Sage Intacct Planning: Taking a Second Look for Nonprofits

Nonprofit budgeting software has never been more important. When Sage Intacct Planning first launched we had Dave, our Sage Intacct demo expert, give a little tutorial on the module and how it worked. But that only scratched the surface. Nonprofits, in particular, have expressed a critical need for an elite budgeting tool while revamping their accounting systems. With this in mind, Dave gave even more examples of how SIP can streamline your budget needs.

But first, let’s talk a bit about how Nonprofits benefit from accounting in the cloud with Sage Intacct.

The Sage Intacct Advantage

Nonprofits, as we all know, face a crazy set of rules and hurdles that other businesses would shudder at the thought of. And you need a system that can handle the ever-changing demands set by the IRS and reporting services as well as the standards your donors demand from you. So you strive for a system to keep all of your information clear and concise with deep, intelligent reporting. Sage Intacct lays out a few ways they have nonprofits covered so they can worry less about tracking and more about the future of fundraising.

Impressively, Sage Intacct’s sophisticated multidimensional database lets you aggregate transactions and activities across your nonprofit organization:

- Multiple entities

- Multi-currency

- Grants and donor tracking

- Tracking cost centers, like offices or locations

With push-button consolidations, you get fast closings and real-time analytics – in minutes, not weeks – for maximum impact on your nonprofit’s performance.

Many nonprofits receive dozens or hundreds of grants and directed donations in separate income streams. And donors rightfully want to know how their investments are faring. Sage Intacct fund accounting creates separate closes for each revenue source along with a regular series of specific reports, each with its own unique requirements, for every funding source.

Sage Intacct fund accounting helps generate:

- Statements of activities

- Financial position reports

- Cash flow financials

- Form 990

Strict Internal Control

Grant tracking. Fund management. Capital budgets. Every number reported needs to be concise and accurate. This is why Sage Intacct had built-in safeguards to ensure your data is clean and accurate.

Sage Intacct accounting software gives you features for centralized control and distributed responsibility in one system, so you can:

- Manage monies by grants/donors, programs, geographies, and other dimensions

- Achieve a granular level of accuracy

- Set budgets for each event, campaign, program, and funding source

- Track the actual number to create tighter controls and prevent unexpected outcomes

- Manage capital budgets

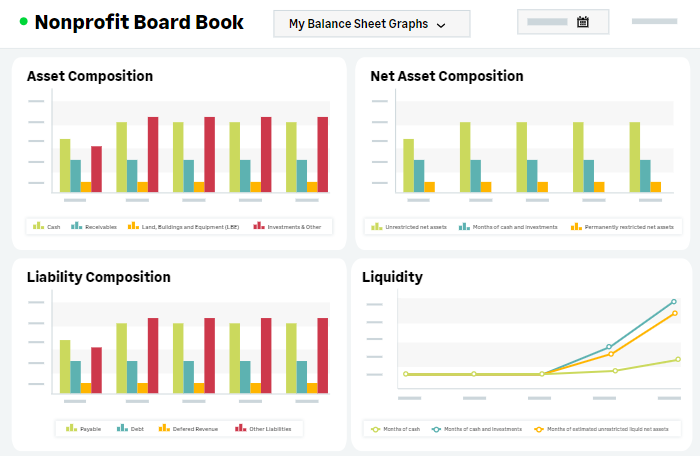

Thankfully, to maximize reporting, Sage Intacct has partnered with the leading nonprofit information center Guidestar to develop the “Guidestar Digital Boardbook” to even further bolster it’s already deep reporting and data visualization capabilities.

The Demo

Finally, we get to the good stuff. Below you can check out our second Sage Intacct Planning demo.